Understanding insurance for each life stage

The importance of planning ahead

Understand and reevaluate

Each life phase involves different insurance needs and requires different coverage. Insurance should never entail a “buy and forget about it” strategy. Life circumstances change and so do your insurance needs. The best approach for any insurance plan is to revisit it at certain time intervals and adjust it to ensure it covers your current and medium-term circumstances.

Your ideal financial journey may be very different in reality as you face any number of issues and challenges.

Financial security

Depending on your life stage, different types of insurance are better suited to help protect your income or protect your assets.

Early adulthood

Consider income protection for your dependent family through term life insurance, permanent life insurance and long-term disability.

Throughout adulthood

Don’t underestimate the cost of an unexpected illness at any stage of your life. Critical illness insurance serves to protect both your income and assets.

Middle to late adulthood

If you no longer have dependent children, you could shift to permanent life insurance for asset protection and long-term care insurance.

Motor vehicle traffic collisions 2017:

Fatalities: 1,841

Serious injuries: 9,960

Injuries: 154,886

Source: Government of Canada

1 in 6 Canadians will experience a disability for 3 months or more before the age of 50.

Source: MoneySense; “Hit by an Iceberg: Coping with Disability in Mid-Career,” By Janet Freedman

2 in 5 Canadians are expected to develop cancer within their lifetime. Cancer is the fourth-most costly disease in Canada.

Source: Canadian Cancer Society

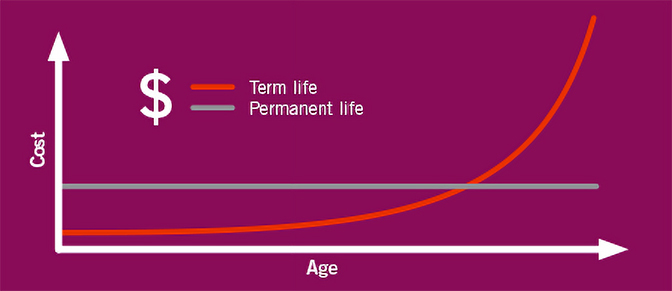

Life insurance: Term vs permanent

Don’t leave your long-term insurance planning too long. Insurance gets more expensive as you age.

Term life insurance

This is affordable in the early years. Premiums then rise at certain time intervals, increasing exponentially in the later years.

Permanent life insurance

While it is more expensive to purchase initially, it can be structured to keep premiums level for your lifetime.

Permanent life insurance for estate planning can provide:

- Funding for your tax liability at death

- Estate equalization needs (e.g. keeping the family cottage for the next generation)

- Gifts to charity

Life is complex. Proper insurance planning can help smooth the path ahead.

Please contact us should you have any questions.